The Union Budget 2025, presented by Hon’ble Finance Minister Nirmala Sitharaman on February 1, 2025, introduced several changes to India’s income tax structure, aiming to simplify tax compliance and provide relief to taxpayers. The government continues to push for the new tax regime, making it more attractive than before. Below is a detailed breakdown of the revised income tax slabs and their implications for taxpayers.

Income Tax Slab Rate for FY 25-26

New revised income tax slab for financial year 2025-26 is as follows

Key Changes in the New Tax Regima

- Increase in Basic Exemption Limit : Tax-free income threshold limit has been increased from

₹3,00,000 to ₹4,00,000,which means individual having income upto ₹4,00,000, need not to pay any tax.

- Increase in Rebate under section 87A : Rebate has been increased from ₹20,000 to ₹60,000,which means individuals having income upto ₹ 12,00,000 would not require to pay tax, as their tax liability shall be reduced by rebate of ₹60,000.

-

Standard Deduction : Standard Deduction for salaried individual remain unchanged to ₹ 75,000/-

-

No Changes in the Old Tax Regime: The government has kept the old tax structure unchanged for those who opt to continue under it

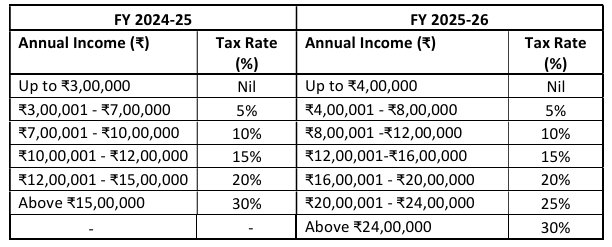

Comparison of slab rate for FY 2024-25 and 2025-26

For the better understanding of changes and its impact on individual tax payers, let compare slab rate for FY 2024-25 and FY 2025-26

For FY 2025-26 basic income exemption limit increased from 3 lakh to 4 lakh and slab rate increased from 15 lakh to 24 lakh. A new tax rate of 25% introduced which was not in FY 2024-25. Lets compare that how much tax is payable by individuals at different level of income.

It can be seen that in financial year 2025-26 individuals having income upto ₹24,00,000 will have to pay tax upto ₹3,00,000, which was ₹4,10,000 for FY 2024-25. Hence individuals will get benefit of Rs. 1,10,000/- in tax liability in FY 2025-26. Hence tax burden on individuals will reduce and will increase their savings.

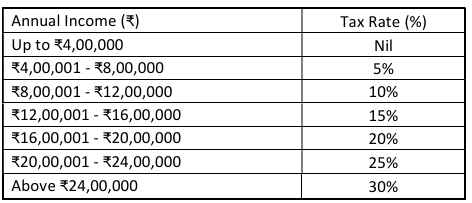

Slab Rate for Old Tax Regime

Income tax slab rate for old tax regime are:

What changed in Old Tax Regime?

The old tax regime has not undergone any major structural changes in the Union Budget 2025. However, a few key points related to it are:

- Standard Deduction Retained: A standard deduction of ₹50,000 remains applicable under the old regime.

- No Changes in Tax Slabs: The income tax slabs under the old regime remain the same as before.

- Deductions and Exemptions Continue: Taxpayers opting for the old regime can still avail deductions under Section 80C, 80D, HRA, LTA, Home Loan Interest (Section 24B), etc.

Who Should Choose Which Regime?

- New Tax Regime is Suitable for: Salaried individuals who do not claim large deductions, those with simple income structures, and people looking for lower tax rates with fewer complications.

- Old Tax Regime is Suitable for: Taxpayers who heavily invest in Section 80C instruments (PPF, LIC, ELSS), claim HRA benefits, or have home loan interest deductions.

- Impact on Middle-Class Taxpayers: The new regime benefits middle-class salaried individuals who do not use exemptions extensively, while business owners and high-salaried individuals may still find the old regime advantageous.

Government’s Rationale for the Changes

- Encourage taxpayers to shift to the new regime by making it more attractive.

- Boost disposable income, leading to higher spending and economic growth.

- Simplify tax filing by reducing dependency on multiple exemptions.

According to government estimates, over 75% of taxpayers are expected to opt for the new tax regime in FY 2025-26.